Separation from Service

What to Do If You Are Separating from Service at Geneseo

- Letter of Intent to Resign or Retire

-

Employees separating from service at SUNY Geneseo should write a letter of resignation or retirement informing the College of their last day of work and their intended beginning-of-business date of resignation/retirement. (Employees who are on a temporary appointment that has ended are exempt from writing this letter unless the temporary appointment is ending earlier than the original end date. In this case, a letter will then be required.)

Employees who are retiring should use the Intent to Resign or Intent to Retire Form letter found at: HR Forms.

For classified service employees, this letter should be completed and sent at least 2 weeks prior to the date of separation. This letter should be addressed to the AVP of Human Resources (Julie Briggs) and copied to your immediate supervisor and cabinet-level administrator. The letter should be given to your immediate supervisor to route and complete additional forms.

For unclassified service employees (professional and faculty), this letter should be received by Human Resources at least 30 days prior to the date of separation. This letter should be addressed to your Cabinet-level Administrator and copied to your immediate supervisor and human resources. The letter should be given to your immediate supervisor to route and complete forms.

- Pre-Retirement Planning

-

For those employees who are retiring from SUNY Geneseo, please contact Human Resources to schedule a pre-retirement informational meeting (585)-245-5616.

Prior to your meeting, we have plenty of pre-retirement planning information and resources for you!

- Separation From Service Policy & Sign-off Form

-

All employees separating from service need to work with their immediate supervisor and complete the Separation Sign-off Form. This form is a checklist that helps you determine if you need to return any College property, pay any outstanding fines, turn off building card access, and/or complete final timesheets PRIOR to your last day of work.

Benefits Exit Information

- Unemployment Insurance

-

You have the right to file an application for unemployment insurance with the NYS Department of Labor.

- Unemployment insurance is temporary income for eligible workers who are out of work through no fault of their own. It provides a weekly benefit while looking for work.

- Human Resources & Payroll Services will provide to employees a Record of Employment form that includes employer information and how to apply for NYS Unemployment Insurance.

- Exit Interview

-

Employees will have an opportunity to have an exit interview. The exit interview is conducted by a neutral third party organization using a confidential telephone survey process.

- Employees who have communicated an upcoming separation will be contacted by the Rochester Chamber of Commerce Staffing Division (RCC) prior to their last day of work.

- The interview should last approximately 15 - 20 minutes in duration. The telephone interview should be conducted in a private location, such as the employee's private office, a conference room, or an employee can schedule the telephone interview to be conducted in a private office in Human Resources.

- Health Insurance & Prescription Drug

-

Your health insurance and prescription drug coverage will terminate 28 days after the last day of the last pay period worked. You may be eligible to continue coverage under the COBRA law. The health care benefits you may continue are the same benefits that you receive as an active employee enrolled in the New York State Health Insurance Program (i.e., Empire Plan or HMO).

- The Department of Civil Service Employee Benefits Division administers the COBRA program and will mail information explaining your rights under COBRA, a Federal continuation of coverage law fro you and any eligible dependents. The law provides you an opportunity to continue these benefits should you or any dependents lose eligibility for these benefits. This mailing will include a COBRA costs and an application. If your address is changing, be sure to update Human Resources & Payroll Services with this information via the SUNYHR portal.

- You will have 60 days from the date of the COBRA-qualifying event or 60 days from the date you are notified of your eligibility for continuation coverage, whichever is later.

- You may have the opportunity to continue coverage under COBRA for up to 36 months. For more information, see page 42 of the NYSHIP General Information Book.

NOTEIf you have met a minimum service requirement (ten full-time years) and are a vested member of a retirement system eligible to continue health insurance in a vested or retiree status. For further information, please call Human Resources & Payroll Services at (585) 245-5616.

- Dental and Vision

-

Employee Benefit Fund (UUP and CSEA): Dental and Vision plans you may have received as an employee are not part of your health insurance and do not continue automatically. If you received these plans as an active employee from a union Employee Benefit Fund, contact your fund for COBRA information; 60-day deadline applies.

- UUP Benefit Trust Fund - 1-800-342-4206

- UUP dental and vision benefits terminate the last day of the month following the month in which you were last paid.

- CSEA Employee Benefit Fund - 1 800 323-2732

- CSEA dental and vision benefits will terminate 28 days after your last day on payroll.

State of New York (M/C, PBANYS, PEF, NYSCOPBA): If you received these plans through the State, your employee dental and vision coverage will end 28 days after the last day of the last payroll period in which you worked. To continue under COBRA, contact the Employee Benefits Division at: 518-457-5754 or 1-800-833-4344.

- UUP Benefit Trust Fund - 1-800-342-4206

- Retirement

-

SUNY Optional Retirement System (TIAA, Fidelity, Corebridge Financial, Voya)

Contact your investment provider for information on leaving state service, withdrawal/rollover options and any subsequent tax implications. Authorized investment providers and contact information can be accessed at https://www.geneseo.edu/hr/retirement. Additional information can also be found on the SUNY ORP website.

NYS Employees Retirement System

- Read Life Changes: What if I Leave Public Employment for answers to questions concerning your ERS membership if you leave state service.

- Contact ERS using their secure contact form or call them at 1-866-805-0990

NYS Teachers Retirement

- NYSTRS Participants should consult their active member handbook about leaving state service, vested status, and withdrawal options.

- Contact TRS via email at communit@nystrs.org or call 1-800-348-7298

- SUNY Voluntary Plan (403b & 457)

-

Employees enrolled in the SUNY 403(b) Voluntary Retirement Savings Plan should cancel their voluntary deductions through the SUNY Retirement@Work portal or by contacting your investment provider. Authorized investment providers and contact information can be accessed at https://www.geneseo.edu/hr/retirement.

Employees enrolled in the NYS Deferred Compensation Program (457) should contact our campus representative about cancellation of deductions and/or other options.

Mark Wallace - 716-903-7253 mark.wallace@nationwide.com

- Leave Accruals

-

- In accordance with NYS guidelines and if your final timesheet has been submitted, you can be paid for up to 30 days of unused vacation accruals that you may have at the time of separation.

- Our payroll office must wait two pay periods after the date of separation due to the Office of the State Comptroller rules.

- This payment can be delayed if an employee's Separation Sign-off Form has not been completed and timesheets haven't been turned in.

- Employees who transfer to another state agency can transfer their accruals to the new agency.

- Unused accrued holiday leave, sick leave and compensatory time cannot be paid out.

- In accordance with NYS guidelines and if your final timesheet has been submitted, you can be paid for up to 30 days of unused vacation accruals that you may have at the time of separation.

- Last Paychecks

-

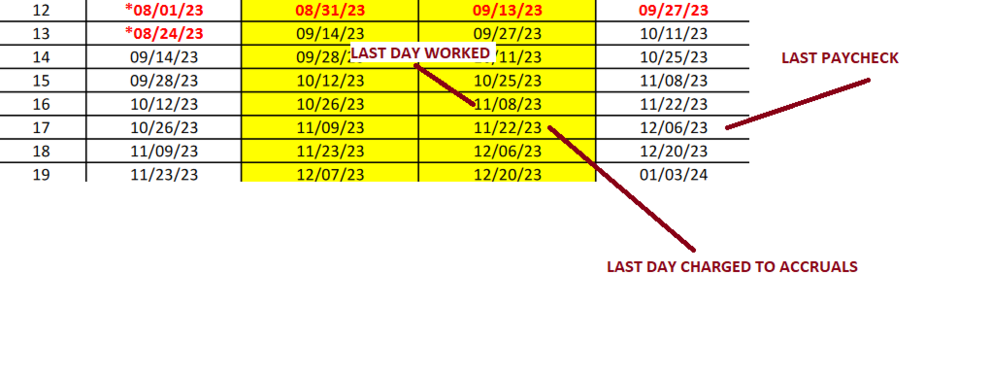

Your last paycheck is based on your last day on our payroll. To determine what your last paycheck will be, you'll need the correct current Administrative Payroll Calendar. Below is an example on how to determine when your last paycheck will be. As always, call us for help!

- If your last day worked was 11/08/2023, close of business,

- then you charge appropriate accruals with supervisor approval from 11/09/2023 through 11/22/2023, close of business.

- This will make your date of separation (termination, resignation or retirement) effective 11/23/2023, beginning of business.

- Your last paycheck will be on 12/06/2023 as this will pay you through 11/22/2023, close of business.

- 5-day Salary Withholding for M/C, CSEA and PEF Employees

-

This is only applicable to Management/Confidential, CSEA-represented and PEF-represented employees.

- When you began employment with us, you were subject to the 5-day salary withholding where NYS deducted one (1) day of salary from your first five (5) paychecks.

- At the time of separation, these five days of salary are paid back to you based on your salary at the time of separation.

- If you are receiving a payout of unused vacation accruals, these 5 days of withheld salary will be paid back to you in the same paycheck two (2) pay periods after your date of separation.

- If you are not receiving a payout of unused vacation accruals, these 5 days of withheld salary will be paid back to you two (2) pay periods after your date of separation.

- NYS Flex Spending Account

-

Health Care Savings Account (HCSA)

If you separate from service (termination, resignation or retirement), go on a leave without pay or stop contributing to your account, your HCSA coverage will end. You will still be able to submit claims for expenses that occur on or before your last paycheck deduction. Any healthcare services that are received after your contributions stop will not be reimbursed.

Dependent Care Advantage Account (DCAA)

If you go on a leave without pay, your DCAA deductions will automatically stop. When you return from leave, you will need to file a change in status application within 60 days if you would like to re-establish your account for the remainder of the year. If you separate from service (termination, resignation or retirement) your DCAA deductions will automatically stop.

Adoption Advantage Account

If you leave the payroll due to separation of service (termination, resignation or retirement), leave without pay (including leave under the Family and Medical Leave Act), or any other reason, and stop contributing to your account, your eligibility in adoption FSA will be terminated. You will still be able to submit claims for expenses that occur on or before your last paycheck deduction, but any adoption-related expenses that occur after your contributions stop will not be reimbursed.

- Ethics

-

Information from the NYS Ethics Commission for Employees Leaving State Service

- Change of Address

-

Use the employee self-service system to change your address, view paychecks, complete time sheets, and update your personal information.

- Click the "Access Employee Self-Service Button" for the SUNYHR Portal

- Enter your birth date

- You can click on any of the demographic information, address, phone number and emergency contact links to update your information with us.

- If you need to change your legal name, complete this Personal Information Form (also available in the SUNYHR Portal). Complete the form, attach any required documentation and return it to Human Resources & Payroll Services.

- Information for Survivors of New York State Employees